Buying a Home Should Feel Like Shopping With a Trusted Friend

Nobody likes to be sold, including us! Our goal is to make our clients feel like they are shopping with a trusted friend. We will accompany you on that journey, ask questions to understand and offer sound advise when you want it. We believe shopping for a house should not be stressful, it should be fun and enjoyable!

We can help make sense of it all.

We believe the more our clients know, the more confident they will be in their decision making. That is why we focus so much on educating our clients. Set up a zoom meeting with us to find out more. We have no expectations other than answering your questions – and weather you want to buy a new house right now or in a few years, we’d love to take the time and speak with you about it.

We take a long term approach to client relationships: we want you to be 100% satisfied beyond your closing and we would love to build live long relationships, so we can assist you and your family also in the future.

Not Sure Where to Start?

Schedule a Call With Marcus

What is a Buyer Consultation?

We believe that knowledge is power, that’s why we like to go over the following with new clients:

- Your goals and what you are looking for

- What the market has to offer

- How the process works, step by step

- Strategies for success

- Any and all questions you have

- Customized MLS access

Check Available Dates and Times:

Tired of searching the web?

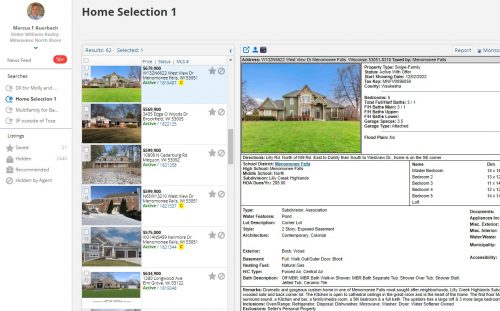

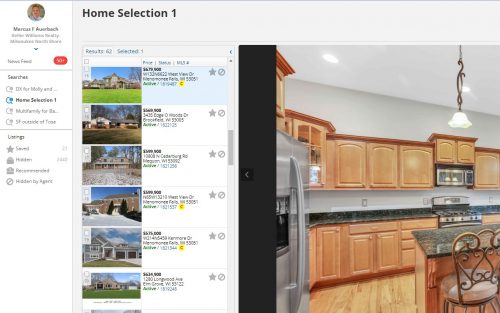

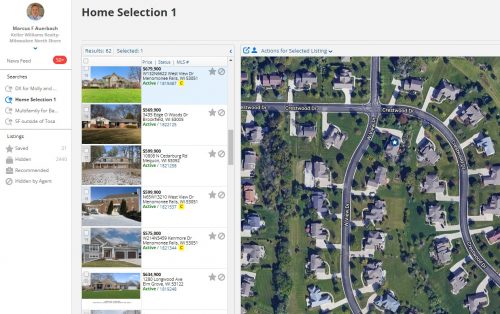

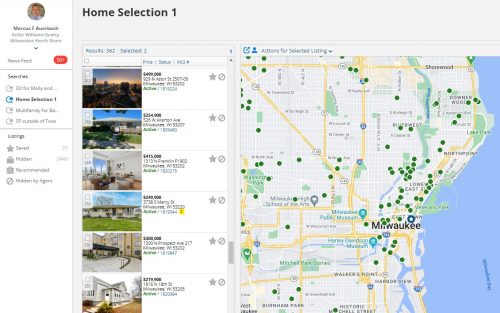

Get MLS Access! And Search Like a Pro!

How MLS Works:

Free real estate websites are great, but the homes listed for sale are not always up to date. You are searching multiple apps and sites and you are still wondering if you have seen ALL the houses currently for sale.

MLS (Multiple Listing Service) is the platform agents and brokers use to post and maintain their listings BEFORE the data gets sent out to hundreds of free websites. MLS is accurate and real time, so you can see the status of each listing minute by minute.

Log In to Your Competitive Advantage!

- MLS is the system brokers use

- MLS is real time: see the actual status of every listing

- MLS is complete: no more searching multiple websites

- MLS has all details like room sizes, basement space,..

- MLS allows you to track favorites

Watch this to get to most out of MLS:

Tell us which neighborhoods and price ranges you are interested, we will set you up with custom searches and your personal MLS Login.

FIRST TIME BUYER'S GUIDE

ADVANCED BUYER'S GUIDE

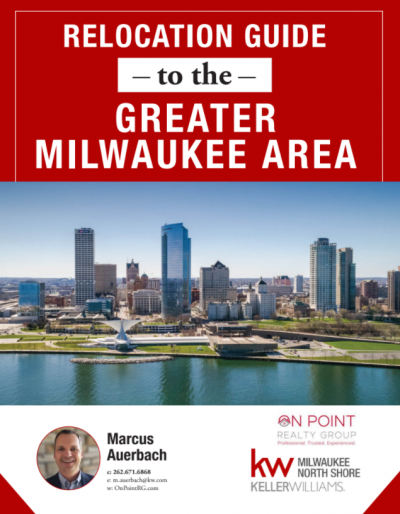

Milwaukee Relocation Guide

Milwaukee Is Trending

You could not have picked a better time to move to Milwaukee! Named “Top 15 emerging downtowns” by Forbes, “Greatest Foodie City” buy the Huffington Post and “Midwest coolest city” by Voge Magazine, “Top Urban Beaches” by US Today and “#1 Emerging Travel Destination” by Airbnb! The city is reinventing itself with over 6 Billion Dollars invested recently in a new downtown skyline along Lake Michigan’s pristine shore line.

Schedule Time With Marcus

Take A Look At My Schedule And Pick A Time That Works For You!

Not sure if it would be better to sell first or buy first? Questions about different options and not sure where to start? Contemplating an investment property? We are here to discuss your personal situation and help you develop the best strategy to reach your goals!

Zoom Call

Phone Call

In Person